Investment Strategy

My Investment Strategy is a completely customized tactical asset allocation investment service, with enhanced planning and reporting.

-

Risk Management is the cornerstone of the Strategy. I employ a unique form of technical analysis with traditional fundamental research to provide advanced risk

management strategies. It tells us whether we should be focusing on wealth accumulation strategies or wealth preservation strategies. This combination of

analysis can help you:

- Reduce Risk

- Preserve Capital

- Generate Wealth

- I provide a comprehensive solution overlaying accounts of various types including your registered, open, joint, spousal, trust and personal corporations.

- A comprehensive lineup of investment choices in stocks, mutual funds and ETFs.

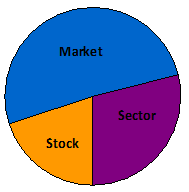

Causes of Price Movement

Market and sector forces together cause 80% of the price movement in a stock. That means the company fundamentals account for less than 20% of a stock's price movement. This is the reason a company's stock price sometimes seems to move independently of the fundamentals!

Source: “The Latent Statistical Structure of Securities”, Benjamin F. King

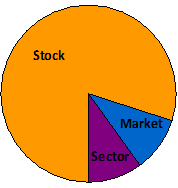

Typical Resource Allocation

Most people, however, spend 80% of their time on stock evaluation and only 20% on sector and market evaluation. In other words, they ignore where the greatest amount of risk lies - the market and sector forces.

The Five-Step Game Plan

Step 1: Market Analysis

Step 2: Sector Analysis

Step 3: Fundamental Research

Step 4: Technical Research

Step 5: Continual Follow-up

IIROC Advisor Report – Investors may research the background,

qualifications and disciplinary information on advisors at IIROC-regulated firms by referencing to the IIROC Advisor Report found here

CIPF coverage and IIROC membership is only applicable to Queensbury Securities Inc.

The information contained herein was obtained from sources believed to be reliable, however, its accuracy or completeness is not guaranteed and Queensbury Securities assumes no responsibility or liability. Neither the information nor any opinion expressed constitutes a solicitation by us of the purchase or sale of any securities or commodities. These comments and opinions are not necessarily the opinions of Queensbury Securities Inc. Securities mentioned may not suit all types of investors. Before making any investment decision, contact your investment advisor to discuss your investment needs. The information on this web site is intended for use for persons residing in British Columbia and Alberta only. All products and services mentioned are made available in accordance with local law (including applicable securities laws) and only when be lawfully offered for sale. All products and services are subject to the terms of the Applicable Agreement.