With the TSX having a strong pullback yesterday, it's tempting to go bargain hunting. But how do you know what's a

bargain? One of the many tools we use when evaluating a stock is the Reward to Risk ratio.

Reward/Risk analysis is a very important component of stock selection. Such analysis helps identify the potential

return compared to the risk taken. Basically, for each $ of risk, how many $$$ of potential return is there. To calculate this ratio you need three numbers:

-

Buy price

-

Price Objective - if things go wright

-

Sell price - if things go wrong where you would sell

The difference between the Price Objective and the Buy price is your Potential Reward.

The difference between your Buy price and Sell price is the Risk.

Potential Reward/Risk = Reward to Risk Ratio

Ideally we like to see at least a two-to-one ratio. Basically, for every $1 of Risk we want at least $2 of

Potential Reward. Let's look at an example:

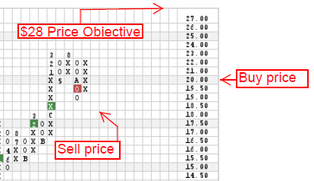

This stock is in a strong uptrend and after multiple buy signals, has pulled back to give a sell signal. This looks

to be a Shakeout pattern (shake out the weak holders of the stock). The stock is currently trading at $20. To evaluate our Reward/Risk we calculate the Price Objective to be

$28. How we calculate this is another discussion. Our Sell price would be $18 as this would create another sell signal.

Potential Reward ($28-$20) = $8

Risk ($20-$18) = $2

$8/$2 = 4 to 1

So, for every $1 of Risk there is a Potential Reward of $4.

When going through and trying to decide which stocks to buy and where, reward/risk characteristics is a very important

component to consider.